Some tax situations require an original “wet” signature instead of electronic filing. This typically occurs when:

- Filing certain amended returns (Form 1040X)

- Submitting specific schedules that can’t be e-filed

- Meeting IRS requirements for particular circumstances on your 1120S or 1040

Why You Must Sign It Yourself

The IRS requires your personal signature on these documents. As your tax preparer, we cannot sign on your behalf – this ensures legal compliance and protects both you and our practice from potential issues.

Critical: Get Certified Mail Documentation

When mailing your wet signature documents:

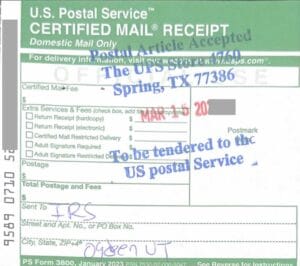

- Always use USPS Certified Mail for proof of delivery

- Keep your certified mail receipt – this is your legal proof

- Upload the receipt to your secure client portal immediately for our records

This documentation protects you if the IRS claims they never received your return and helps us track your filing status.

Need More Information?

- Visit the USPS Certified Mail FAQ for detailed instructions on certified mail service.

- Most post offices close their in-person windows at 5PM. Tax days can be businer, so try to leave at least 15 minutes to wait in line.

Remember: Your certified mail receipt is as important as the tax document itself.